Top 5 trends for property investors in 2023

2023 has started strongly and many worries that investors had about the market are fading into the distance as better news arrives. This is the ideal time to take a step back, assess the market and take a fresh look at property as you plan for the year ahead.

Read on to learn about the top five trends for property investors in 2023, and pick up some property investment tips along the way…

House price growth positive in the medium- and long-term

The big story for those investing in property in 2023 is that house prices may continue to see small falls in value on average in at least the first half of the year. This comes due to the cost of living and rising mortgage rates hitting demand by as much as 50% towards the end of 2022.

Lower demand means that people have been dropping asking prices, leading to the average house price falling in many regions. What’s more, the housing market does not turn immediately, so some of the damage done at the end of last year will keep having an effect this year. However, it is unlikely that this negative outlook will last long.

Tom Bill, head of UK residential research at Knight Frank, agrees, saying: “The first rule for anyone predicting the trajectory of house prices in 2023 should be to ignore any data from the chaotic final quarter of 2022.

“The latest data shows two things are happening at the same time. First, the effect of the mini-Budget is working its way through the system, which means that monthly declines are narrowing. At the same time, an annual fall in house prices appears imminent, underlining how the lending landscape has changed irrespective of the mini-Budget.

“As rates normalise, buyers will increasingly recalculate their financial position and house prices will come under pressure. We expect a 10% decline over the next two years, taking them back to where they were in mid-2021.”

Richard Donnell, executive director of research at Zoopla, agrees, saying: “It’s going to be a slow start to 2023 but we expect demand to pick up in the coming months as the economic outlook becomes clearer and mortgage rates settle around 4% to 4.5%”.

So, there are two things to bear in mind when looking at falling house prices. Firstly, it is likely a temporary issue which will be solved as rates return to normal and the market works itself out. Secondly, any falls must be viewed in context – even the worst case predictions put house prices in-line with or higher than pre-pandemic averages. When that is taken into account, it is clear that there is room for growth sooner rather than later.

Have interest rates and mortgage rates in the UK peaked?

One of the big stories in 2022 was the rising interest rates in the UK. The Bank of England (BoE) raised them over and over again in an attempt to combat inflation, and that trend continued this year with a rise to 4% at the beginning of February.

Andrew Bailey, governor of the Bank of England, believes that inflation may have turned a corner, saying: “Global consumer price inflation remains high, although it is likely to have peaked across many advanced economies, including in the United Kingdom.

“Wholesale gas prices have fallen recently and global supply chain disruption appears to have eased amid a slowing in global demand. Many central banks have continued to tighten monetary policy, although market pricing indicates reductions in policy rates further ahead.”

The main effect that this will have on property is with regard to mortgage rates. If inflation and interest rate rises have peaked, then it is likely that mortgage rates will also start to fall. We have already seen evidence of that in February as five-year fixed mortgage rates under 4% are once again available for the first time since the Autumn of 2022.

If rates have peaked that will be great news for all borrowers, whether they are investors or homebuyers. The more time passes, the lower they could fall – making this an ideal time to buy off-plan property and pay in the future when rates are even lower than they are today.

Rents are high and set to continue growing

Investing in buy to let property is about more than just house prices and mortgage rates. Just as important are rental returns – and the rental market is a hugely positive 2023 trend for investors to look at.

The forces which put people off buying in 2022 had the effect of keeping more people in the rental market than ever before. In response, rents boomed to new heights and provided investors with a timely boost.

Rightmove reported recently that the number of homes available to rent in the UK fell by more than a quarter by the end of 2022. This led to average rental growth of more than 10% over the year according to Savills, and the lack of new incoming supply has led the agency to forecast further growth of 18.3% by 2027.

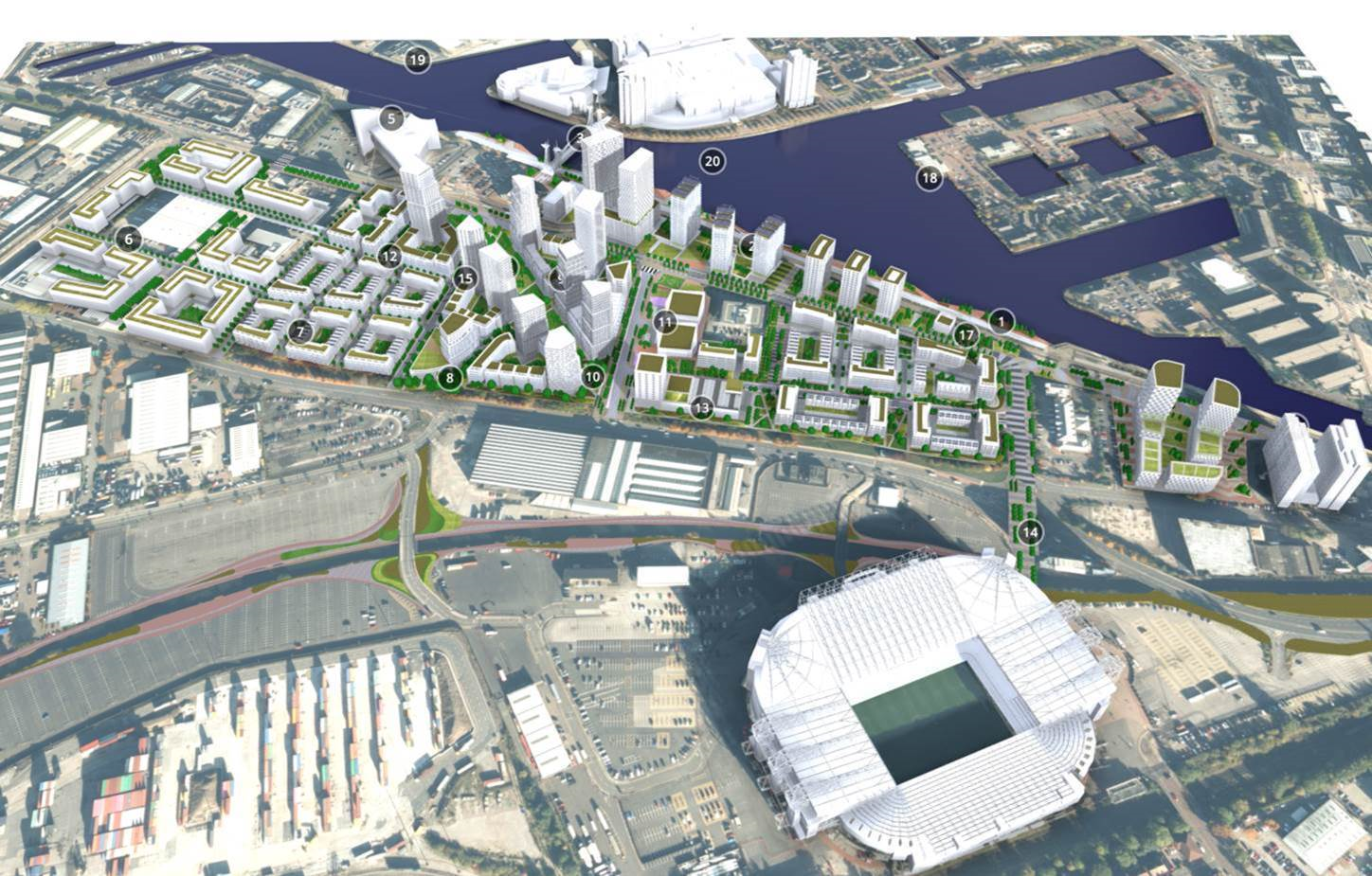

Some areas, such as Manchester, saw growth far beyond the average in 2022. The latest data from Alliance City Living demonstrates how strong the Manchester rental market is right now, and demonstrate why the city continues to be a smart place to invest.

According to their data, rents for studios and three-bedroom apartments reached record highs during November 2022, increasing year-on-year rents by 21.9% on average. Average asking rents for one- and two-bedroom apartments in Manchester also achieved close to record highs of £1,009 pcm and £1,334 respectively by the end of the year.

Whether you look at Manchester’s city centre or the booming new areas on its outskirts, this is a good time to consider a new investment in the city.

New rental regulations

Related the above information on the rental sector, one trend that investors should be aware of in 2023 is the potential for new regulations which will affect your investments.

It is impossible to say for certain when legislation will be announced and passed, but it is possible that acts of Parliament covering the following areas could arrive in 2023:

- scrapping Section 21 evictions

- introducing a Decent Homes Standard

- encouraging increased pet ownership among tenants

None of the above are overly negative for investors, but they will all change the balance of renting slightly and so it is worth being aware of them.

One way to make sure that you are on top of reforms, and your properties are compliant, is to appoint a professional property lettings and management agent to take care of everything. They will inform you of any changes that are required and make sure that you are up to date.

Short-term let sector to continue growing

Short-term lets have never been more popular in the UK. They are perfect for a wide range of renters including business travellers, international students, families on holiday and tourists – making them an investment class with a huge appeal.

As they continue to take space from hotels, short-term lets are attracting more and more investor interest thanks to the following possible benefits on offer:

- Higher yields

- Opportunity to diversify portfolio

- Growing demand

- Fully-managed investment

To find out more about the benefits of investing in a short-term let property, click here to read our article.

Developments in the UK’s most popular short-stay destinations are all set to be ideal investment opportunities in 2023 and beyond. The short-term let trend is here to stay, and should be an option on the radar for all investors.

2023 is set to be yet another strong year for property investment in the UK. The major trends are largely positive, and investors can look at the market with confidence, both in the short-term and into the future.

To find out more about UK property and why this is the right time to invest, get in touch with our team today by clicking here >>

Continue Reading