H1 2024 was turning point for UK property market

2024 has been a great year for the UK housing market. Following more than 18 months of uncertainty and a lack of confidence among buyers, we can now look ahead with much more positivity.

The first six months of 2024 show that the worst times are firmly in the past for investors and homebuyers alike. With better economic times and more stability ahead, this is a great time to invest in UK buy to let property.

Economy and mortgages

H1 2024 saw the UK’s economy reach a turning point. The worst of the high mortgage rates and inflation seen in 2023 have passed and the average rate of interest for borrowers is now back down

The Bank of England has led the way in this regard. After raising the base rate of interest repeatedly over the course of last year, they have now kept it the same for several months. With CPI inflation back down to 2% - from its height of over 10% - the next logical move is to bring the base rate down slowly over the rest of the year.

This will be welcome news for investors using a mortgage to fund their purchase. The five-year average mortgage rate across the Big Six lenders has already fallen to 4.74% according to USwitch.

If the base rate of interest is brought down over the rest of 2024 as expected, it is likely that mortgage rates will continue to reduce as well. This will make buying more affordable and get the market moving faster.

House prices rising again

The improved economic outlook can be seen in house prices which are rising again following the first half of 2024. Buy confidence, wage growth and lower inflation has led Nationwide to state that there was a 1.3% rise in the year to May 2024. This is in contrast to an average fall of 1.6% over the course of 2023.

Andrew Harvey, senior economist at Nationwide, said: "I think we have been a little surprised actually by the resilience in the market because those affordability pressures have been quite significant."

More good news includes the fact that mortgage approvals rose above 60,000 in February for the first time since 2022, and the Royal Institution of Chartered Surveyors reporting that new buyer enquiries rose back into positive territory.

Together, these facts have inspired a lot more positivity in the future of house price growth for UK property. Savills now expects that we will see overall house price growth of 2.5% on average across the UK.

The agency also notes that the Oxford Economics forecast for GDP growth over the next five years has increased from 7.2% to 8.9%, and wage growth from 15.8% to 16.4%. They have therefore increased their five-year forecast for house price growth from 17.9% to 21.6% - and that all starts in the second half of 2024.

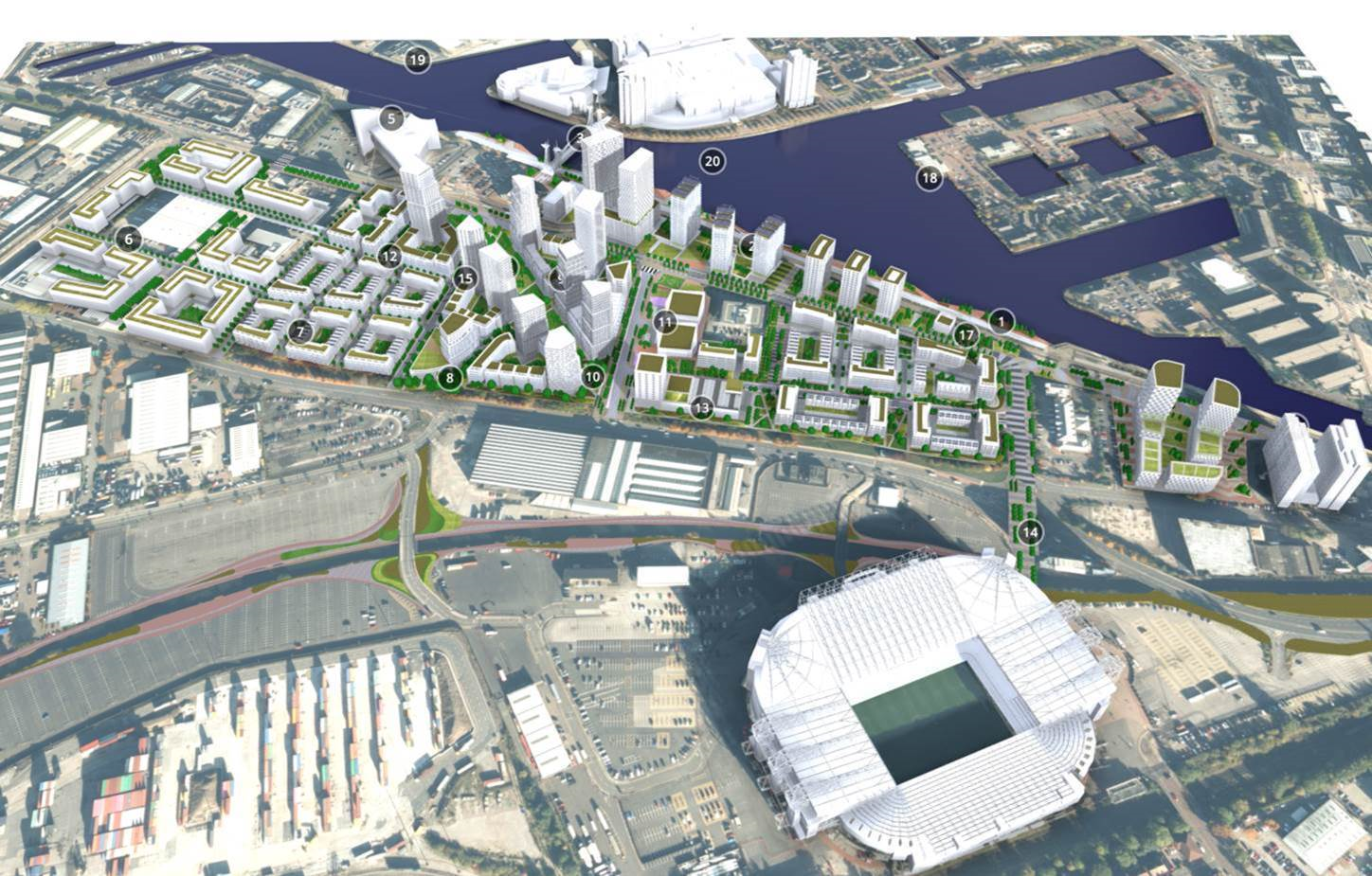

Finally, some areas are likely to see higher growth than others thanks to low supply, high population growth and slow construction rates. For example, this is what makes Manchester buy to let property such a great investment. Find out where the best Manchester buy to let areas are here.

Rents at record highs

Finally, we turn to rental growth which reached record highs in the first half of 2024 and show no signs of slowing down.

Record highs were reached in both March and April, before we finished the first half of the year with the Office for National Statistics saying average rents were up 8.7% year-on-year in June.

Richard Donnell, Zoopla research director, said: “For the past two and a half years rents have outpaced earnings by a significant amount.”

In fact, rents have grown so much that the big questions this year was whether we are approaching the ceiling of affordability for renters.

This is a good situation to be in for landlords, and it makes it more important than ever to invest in markets where there is still a lot of room for future growth. For example, Manchester and Birmingham are both cities where the population continues to grow rapidly and there are nowhere near enough homes being built.

As the economy continues to pick up, people’s disposable income will increase and the competition for homes in city centre markets like those will become fiercer – leading to further rental growth.

Want to learn more about where you can find the best buy to let investment properties in the UK? Get in touch today to speak to our experts.

Continue Reading