Tax benefits of UK property investment: Maximising returns

UK property has proven itself to be stable, profitable and reliable in recent years. No matter what economic difficulties or global events have thrown at it, the market remains healthy. Rents are higher than ever and capital appreciation prospects are on track to recover and grow from 2024 onwards.

If you are looking to invest in property and make the most of this opportunity, there are many considerations. One of the most important is understanding your tax liabilities at all stages. By doing so, you will be able to maximise your returns and give yourself the best chance of success.

Please be aware that Alliance Investments is not a qualified tax advisor and we highly recommend that you talk to an independent financial advisor before investing in UK property.

Stamp Duty Land Tax (SDLT) in 2023

Stamp Duty Land Tax (SDLT) is applied to all residential property purchases in this country which have a value exceeding £125,000. It is a legal requirement on all qualifying purchases and one you must be aware of when investing.

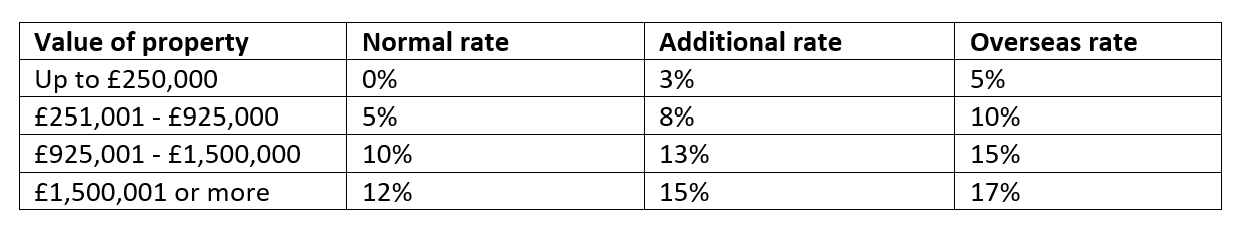

Furthermore, there is an additional 3% surcharge payable by all investors when buying a property that is not your primary residence, and another 2% is applicable to overseas investors since April 2021. Stamp Duty is calculated on a sliding scale as follows:

(accurate as of Q4 2023)

While it is true that you will pay more if you are an investor from the UK or abroad, the amount should not be off putting. For example, if you are investing in Manchester property, you can enjoy rental income which has increased by 25% in the last year for prime luxury apartments. Similarly, Savills is anticipating property values in the region will increase by more than 22% by 2027. Any surcharge you pay is likely to be dwarfed by the gains you will make.

Finally, Stamp Duty must be paid within 30 days of completing in your purchase. If you do not pay within this time limit, you risk a fine.

Income Tax

Income tax is payable on all rental returns you make from any UK property. The rate goes from a basic 20% to a maximum of 45% depending on the level of income you receive.

If you live outside the UK, you will have to sign up to the Non-Resident Landlord Scheme. This is how HMRC collects taxable income from landlords who spend most at least six months of the year living somewhere other than the UK.

For more information on how this scheme will work for you, please contact an independent financial advisor.

Capital Gains Tax (CGT)

If you choose to sell your property at a later date and make a profit over the original purchase price, you will be subject to Capital gains Tax (CGT). It is payable as a percentage of the aforementioned profit, or the ‘capital gain’.

It is charged to both domestic and overseas buyers in exactly the same way and the rate will be up to either 18% or 28% depending on your tax band as an individual. If you are working through a trust or a company, the rate will be up to 28% or 20% respectively.

Inheritance Tax

Inheritance tax is paid on the estate of someone who has passed away and is liable on any assets valued over the threshold of £325,000. Any part of your estate above that threshold will be charged at a rate of 40% as standard.

A reduced rate of 36% is available if you leave 10% or more of the NET value to charity. In this case, the NET value is the estate’s total value minus any debts.

If you wish to pass on your assets to a spouse or relative before you die to reduce your potential UK tax, please consult an independent financial advisor for legal advice.

Council Tax

Finally, Council Tax is not something that you will regularly pay yourself. It is usually paid by the tenant. However, if the property is ever empty due to a void period then the landlord is responsible until a new tenant moves in. It is likely that this will be a minimum of £80 a month.

The easiest way to avoid being liable for Council Tax at any point is to invest in an area where demand is a lot higher than supply. By doing so, you can get access to a huge pool of tenants and ensure that the property is never empty.

Want to learn more about where in the UK is best to invest in property in 2023? Get in touch with our team for information and to discover more about the most profitable UK investment locations today by clicking here.

Continue Reading