How to beat the mortgage price rises

News about the UK interest rates going up again to a 15-year high of 5% arrived at the end of June and it came with major repercussions for the property market. Specifically, it has taken mortgage interest rates to 6.66% again and left many facing unaffordable housing costs.

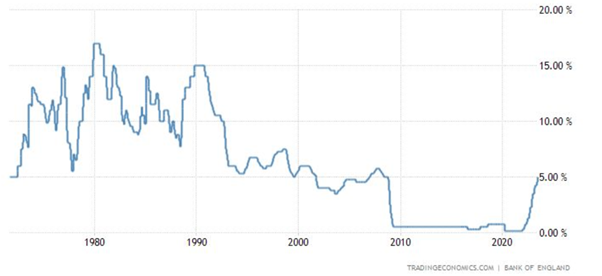

While the rate rises are high, it is true that they were previously at such a low rate that the newer level is not as bad as it appears. Historically, rates are still extremely low as demonstrated here:

However, many investors and homebuyers have still become more hesitant thanks to rising costs. It also led many to question whether this was the right time to invest in UK property or whether a period of caution was the right move, and a halt to anymore purchases might be safer. These are absolutely fair concerns and they are shared by many in the industry.

However, while it is a good time to consider your portfolio and the affordability of new purchases, there is a way to beat the mortgage price rises and escape the trap which has caused some to panic. The way to do so is to look at buying property off-plan. You can learn more about what we mean by off-plan property purchases by clicking here.

In this article, we have laid out the benefits of doing so. Read on to find out more…

You only pay the deposit up front

With a traditional property purchase you will be expected to pay the full amount up front – that is, get a mortgage or pay in cash straight away. This means that you will have to have the whole finance package complete and ready and if you are using a mortgage you will be hit by the 6%-or-higher mortgage rates that are now a reality. Indeed, they could rise even higher in the near future.

This adds a huge amount onto any purchase, and when the UK average house price is as high as £300,000 or more according to some outlets, that can make the entire purchase unaffordable.

In contrast, when you buy off-plan, you typically only pay a small deposit of as little as £5,000 up front, and in some cases a small percentage of the overall purchase cost. This is a much more affordable initial payment which gives you greater flexibility and buying power.

What about the remainder of the purchase price? Well, with an off-plan property, you can…

…push the main payment into the future

Instead of owing everything at once, you will instead pay the remaining balance of the purchase on the completion of the property. This gives you a major advantage and can help you beat the current mortgage costs and still expand your portfolio.

An off-plan property is typically made available for purchase as much as three years ahead of its completion. This gives you plenty of time to finance the deal following the initial deposit and exchange of contracts, and it also gives the mortgage market a chance to return to normality.

Nothing is guaranteed, and we would always advise you speak to an independent financial advisor before agreeing a purchase. However, forecasts show that it is unlikely the current conditions will last in the long term as they are a temporary measure to reduce inflation. Once that is under control, the base rate of interest should fall again and mortgage interest rates with it.

Buying off-plan as either an investor or a homeowner can be a method of securing a property now at a below-market rate but paying for it in the future when rates have returned to normal. In the meantime, you will also have been generating capital appreciation over the course of the build which means you could immediately be in profit upon completion too.

Want to learn more about off-plan property purchases? Get in touch with the team today by clicking here >>

Continue Reading

-1.png)