Investor Insights - What will influence the 2023 housing market?

The UK property market experienced initial highs in 2022 before more caution set in during the latter half of the year. The first two quarters of 2022 were a continuation of what we have come to expect from property in recent years.

Low interest rates and strong demand combined to keep pushing house prices upwards. Up to June 2022, the Halifax recorded average growth of £17,500 for the typical property – and of course, the strongest markets like Manchester saw growth far in excess of that.

However, the second half of the year saw a slowdown thanks to a variety of factors which combined to change market conditions. Interest rates rose and made borrowing more expensive at the same time as cost of living crisis began to restrict people’s spending. Together, these factors injected a dose of caution into the market and caused a flattening of house prices over the summer, before an average fall of 2.3% recorded in November 2022.

Overall, the numbers were enough for the Royal Institution of Chartered Surveyors (RICS) to declare that the UK’s 13-year housing boom may be coming to an end – at least temporarily.

Figures from Nationwide support this, showing that overall annual growth in 2022 was just 2.8% on average, despite a strong start to the year. Furthermore, this challenging climate is likely to have further effects in 2023 according to Robert Gardner, Nationwide’s chief economist, who said: “The market has undoubtedly been impacted by the turmoil following the mini-budget, which led to a sharp rise in market interest rates.

“Higher borrowing costs have added to stretched housing affordability at a time when household finances are already under pressure from high inflation.”

So, is investing in property in 2023 a good idea? There are three major things to bear in mind when considering whether you should invest in UK property in 2023. The first is that UK house prices in 2023 are still at historically high levels despite a small slowdown. The context that we must bear in mind is that the average property in the UK increased in value by 23% between March 2020 and August 2022.

This means that even the slight softening of the market that we have already seen puts property prices in the UK far above any pre-pandemic highs on record – at least 19.4% more, in fact.

Likewise, even though it seems likely that house prices may fall a little further in 2023, they will still be very high compared to their previous levels, and investors can still have confidence in the market.

Andrew Asaam, Homes Director at Halifax, says: “Looking ahead to next year, it will clearly be a more challenging economic environment and the housing market will continue to rebalance to reflect these new norms. Though the limited supply of properties for sale will continue to support prices, the pandemic-driven surge in demand has receded, and we’re emerging out of more than a decade of record low interest rates.

“We therefore expect that UK house prices will decrease by around 8% [in 2023]. To put this into perspective, such a fall would place the average property price back at roughly the level it was in April 2021, reversing only some of the gains made during the pandemic. There is still uncertainty around this forecast, with the trajectory for Base Rate (now expected to peak at 4%) and unemployment levels key to determining any future changes.”

The second thing to consider when looking at whether you should invest in 2023 is that property is a long-term investment. Therefore, what are the projections for the future? The most recent forecasts from Savills show that better times may not be far off.

The agency believes that the average house price in the UK will return to its peak by 2026 and resume setting records in 2027, to a height of £381,578 by the end of that year. This is equivalent to average growth of 18% in the next four years. Some regions including the North West (22.1%), Yorkshire (22.1%) and the West Midlands (19.7%) are predicted to do even better than that. Similarly, Knight Frank expects a return to growth by the end of 2026.

For those looking to invest in cities like Manchester, Preston or Birmingham, 2023 could be a good time to invest ahead of time and plan for the future.

The third factor to think about when considering whether property investment in the UK in 2023 is a good idea is that there are two income streams available to you. House prices and the associated capital gains are one – but you should not forget rental income.

In contrast to house prices, rents did nothing but grow in 2022. The economic conditions which caused people to be more cautious about purchasing a home of their own served the dual purpose of keeping more people in the private rented sector. Due to this, competition for rented homes is fiercer than ever, and rents grew as a consequence.

Rightmove figures show that the number of homes on the market towards the end of 2022 was 26% lower than it had been at the end of 2021. This was matched by an increase in demand and enquiries of 23%.

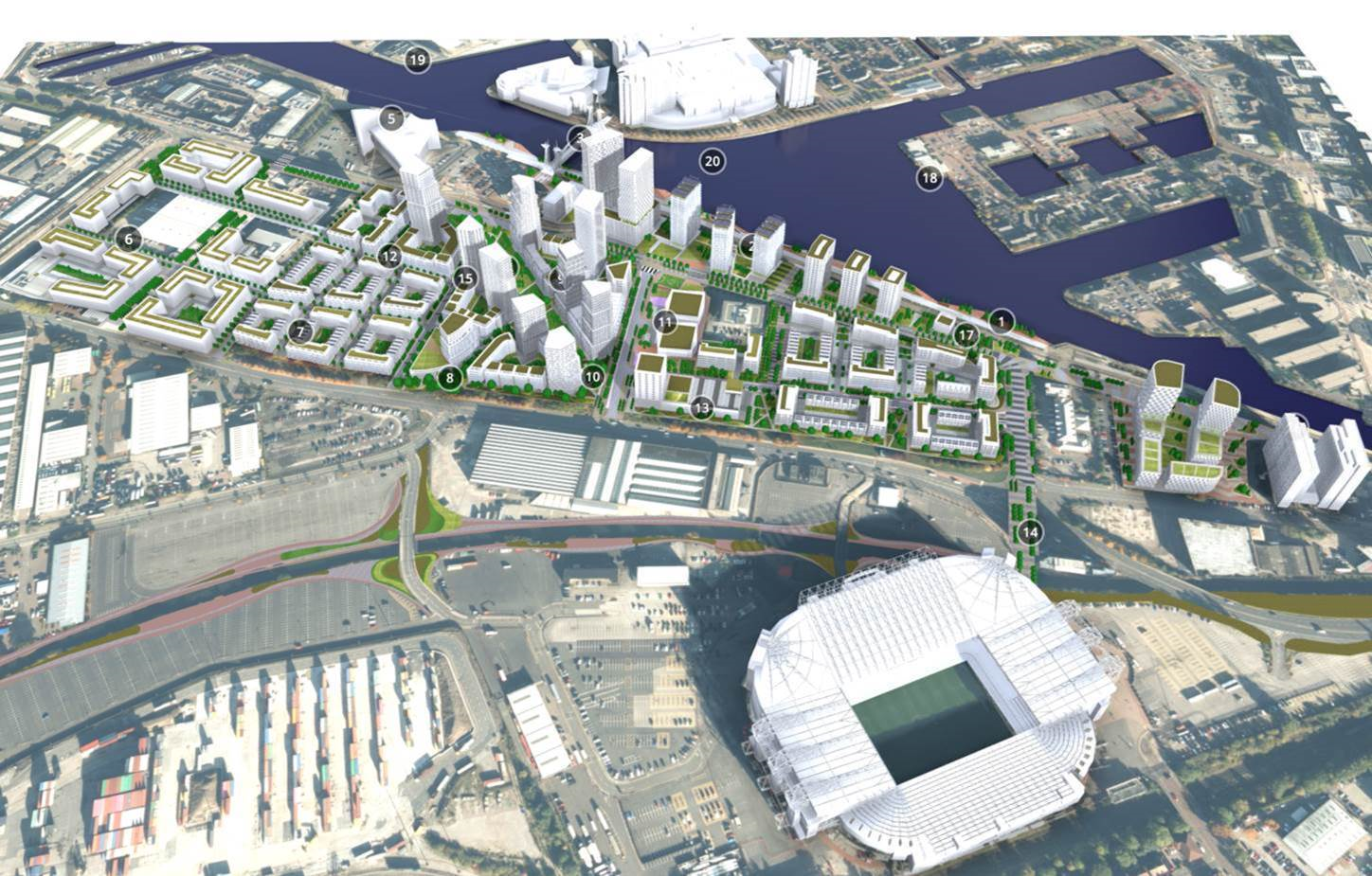

To take Manchester as an example once again, we can see a perfect snapshot of the UK rental market and how the pressures on it are playing out in real life. New data from Alliance City Living has shown that Manchester’s residential property market has once again seen rents achieve record levels. In November, achieved rents for 3 bed apartments, studios and houses all grew to their highest ever point – an increase of 21.9% on average in the last 12 months.

Read more about Manchester’s record-breaking rental market by clicking here >>

By returning to the Savills analysis, we can look ahead to the future and see positive outcomes are likely to continue in the rental sector for property investors. The agency predicts a 6.5% average rise in rents over 2023 and 18% by the end of 2027.

So, by taking all of the above into consideration, we can see that the underlying fundamentals of property investment in the UK remains strong, and that the current economic challenges appear to be temporary.

Property is a long-term investment which offers savvy investors ways to find advantages even in market conditions which may not be ideal on the surface. While it is true that borrowing costs are high, the indications are that they will begin to start falling in a significant way by the end of 2023 and into 2024. As they do, the current slowdown in property prices will begin to reverse, and projections show that real growth is possible again in the next four years. Throughout all that, rents are set to continue rising.

There are two major ways in which investors can make the most of UK property investment in 2023. The first is to invest off-plan – a tried and tested strategy which could now offer more value than ever. By investing now in a development which is due to complete in the future, you can purchase at a lower rate and pay for the property on completion when borrowing costs have returned to normal.

By doing so, you can save money now and cut costs in the future – at the same time as seeing higher profits as capital growth picks up again. You will get all the benefits of future growth while avoiding the negative aspects of buying in the current market.

The second way that investors can benefit in the current economic conditions is by purchasing in cash. Much like with the previous strategy, you can benefit from a lower initial purchase price now than you would have otherwise paid. Additionally, you can choose to remortgage the property on completion in the future when its value has grown and borrowing costs have fallen again.

Finally, those with pre-existing investments can rest easy in the knowledge that rents are continuing to grow, and that by holding on to their properties for a few more years they increase the likelihood of achieving substantial capital appreciation on exiting.

To learn more about our available off-plan property investment opportunities and learn more about the UK market, get in touch with the team today by clicking here >>

Continue Reading